The Tools Behind Our Trading Strategies

In the world of algorithmic trading, having the right tools is essential for developing, testing, and deploying successful trading strategies. At Quant Farmer, we utilize a combination of powerful software and programming languages to craft and optimize our strategies. In this post, we’ll introduce you to the main tools we use: StrategyQuant X and Python.

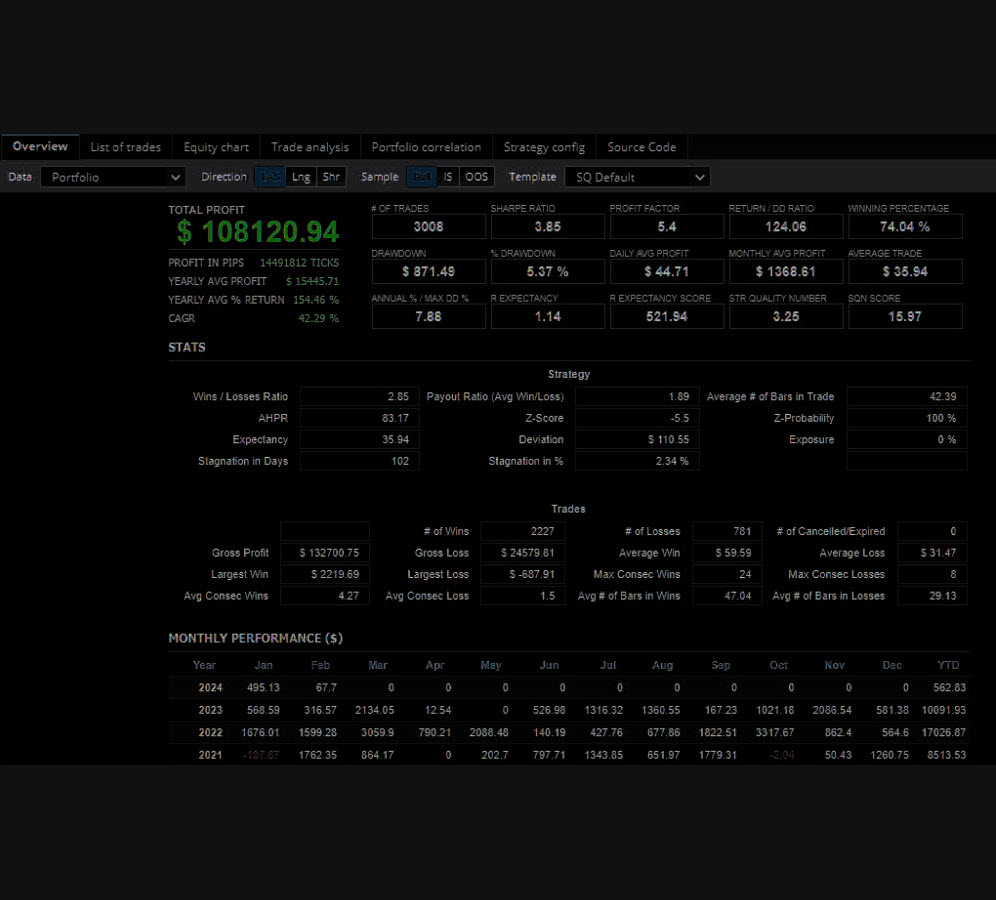

StrategyQuant X: Our Go-To Strategy Development Tool

What is StrategyQuant X?

StrategyQuant X is an advanced platform designed for creating, backtesting, and optimizing trading strategies. It provides a user-friendly interface and a robust set of features that make it an indispensable tool for both novice and experienced traders. Here are some of its key features:

- Strategy Builder: Allows you to create trading strategies without any programming knowledge. You can use its drag-and-drop interface to build strategies based on various technical indicators and rules.

- Backtesting: Offers powerful backtesting capabilities to test your strategies on historical data. This helps in understanding how your strategy would have performed in the past.

- Optimization: Provides tools for optimizing your strategies to ensure they perform well under different market conditions.

- Robustness Testing: Includes advanced testing features to ensure your strategies are not overfitted and can handle real market conditions.

We’ve been using StrategyQuant X since the beginning of our journey, and it has significantly contributed to our ability to develop and refine effective trading strategies.

Python: The Backbone of Our Strategy Development

Why Python?

Python is a versatile and widely-used programming language in the field of quantitative finance. Its simplicity and the vast array of libraries available make it ideal for developing and testing trading strategies. Here are some of the key libraries we use:

- pandas: A powerful data manipulation library that allows us to handle large datasets with ease. It provides tools for reading, writing, and processing time series data, which is crucial for trading strategy development.

- numpy: A fundamental library for numerical computing in Python. It provides support for arrays, matrices, and high-level mathematical functions, making it essential for performing complex calculations.

- ta_lib: Technical Analysis Library for Python. It offers a wide range of technical indicators and functions to analyze financial market data and develop trading signals.

- scipy: Another scientific library that provides tools for optimization, integration, and statistical analysis.

- matplotlib: A plotting library used for creating visualizations to analyze data and results.

The Science of Strategy Development with Python

Using Python, we approach strategy development from a scientific perspective. Here’s a brief overview of our process:

- Data Collection and Cleaning: We gather historical market data and clean it to ensure accuracy.

- Exploratory Data Analysis (EDA): Using libraries like pandas and matplotlib, we perform EDA to understand the data and identify potential patterns and trends.

- Strategy Formulation: Based on our analysis, we formulate trading strategies using technical indicators and rules.

- Backtesting and Optimization: We backtest our strategies on historical data to evaluate their performance. Optimization techniques are then applied to fine-tune the parameters.

- Robustness Testing: To ensure our strategies are not overfitted, we conduct robustness tests to evaluate their performance under different market conditions.

- Deployment: Once a strategy passes all tests, it is deployed to a live trading environment.

Conclusion

Combining the capabilities of StrategyQuant X with the flexibility and power of Python, we have developed a comprehensive toolkit for creating and optimizing trading strategies. StrategyQuant X simplifies the strategy creation and backtesting process, while Python allows us to dive deeper into the data and perform advanced analyses. Together, these tools enable us to develop robust, effective trading strategies that can adapt to changing market conditions.

Stay tuned for more insights and detailed tutorials on how we use these tools to develop our strategies. If you have any questions or would like to learn more, feel free to leave a comment below!