Swing Trading Stocks

We are constantly developing new ideas and sometimes you find yourself getting a surprise. Why not try to back test CFD stocks with the same approach as indices. It should work as it does on indices.

It does!

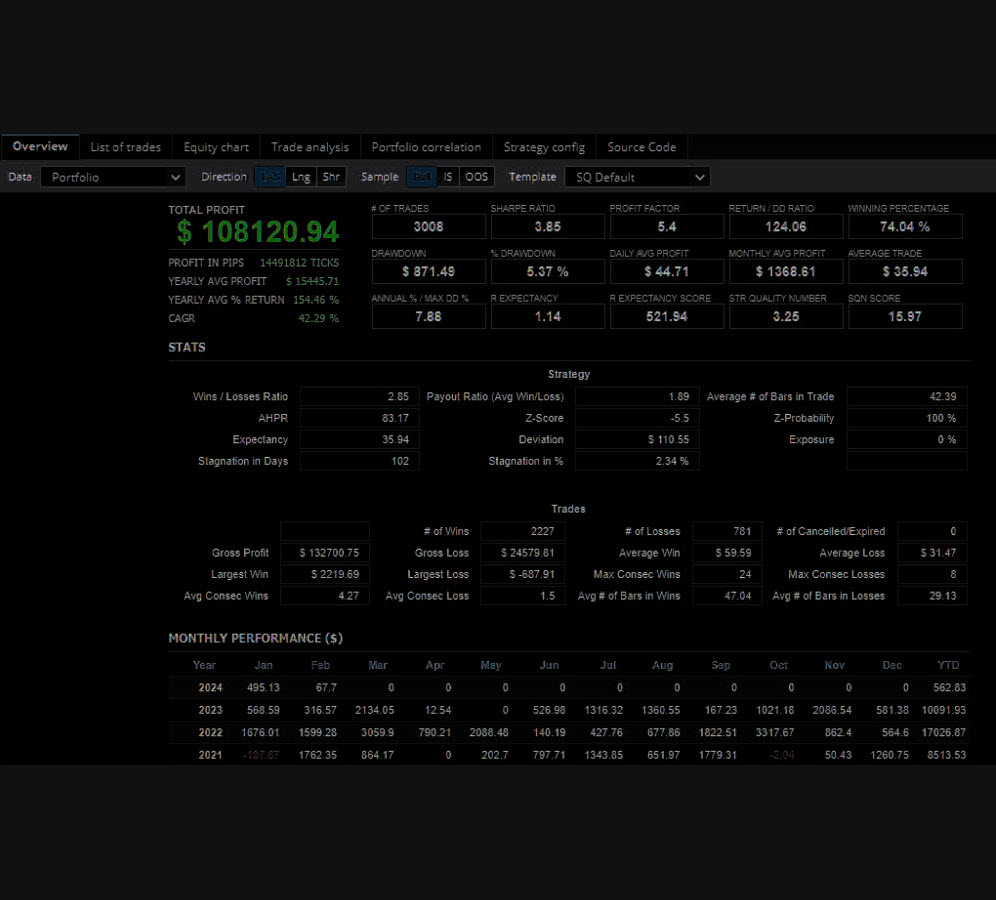

While we don’t have live trading results yet, our simulations have shown exceptional promise. We’ve been retesting our algorithms on a variety of individual CFD stocks—over 60 different stocks, and we’re continually adding more to the portfolio. The results have been nothing short of spectacular.

Here are the key highlights:

- Algorithm Efficiency:

- The same algorithms we employ for indices have been adapted for individual stocks with minimal adjustments.

- The performance on stocks has surpassed our expectations, yielding even better results than with indices.

- Diversity and Stability:

- The diverse nature of stocks means that the overall open drawdown remains stable, even as we add more symbols to the mix.

- This diversification significantly reduces risk while maintaining high returns.

- Performance Metrics:

- Our backtesting data showcases an insanely high Sharpe ratio.

- The open drawdown is extremely low, reflecting the robustness of our strategy.

- You can see the impressive numbers from our back testing in the image above.

- Validation of Approach:

- The fact that our algorithms work seamlessly across different symbols and markets confirms the solidity of this approach.

- This cross-market applicability is a testament to the reliability and adaptability of our trading strategies.

We believe these results underscore the potential of our algorithms to generate consistent and substantial returns in live trading. Stay tuned for more updates as we continue to refine and test our strategies