Introduction

Hello, fellow trading enthusiasts! Since January 1st 2024, we’ve been running a live trading portfolio focused on index CFDs using an algorithmic swing trade system. It’s been quite a journey, and I’m excited to share some insights and results from these past six months.

Indices-Live

Performance Overview

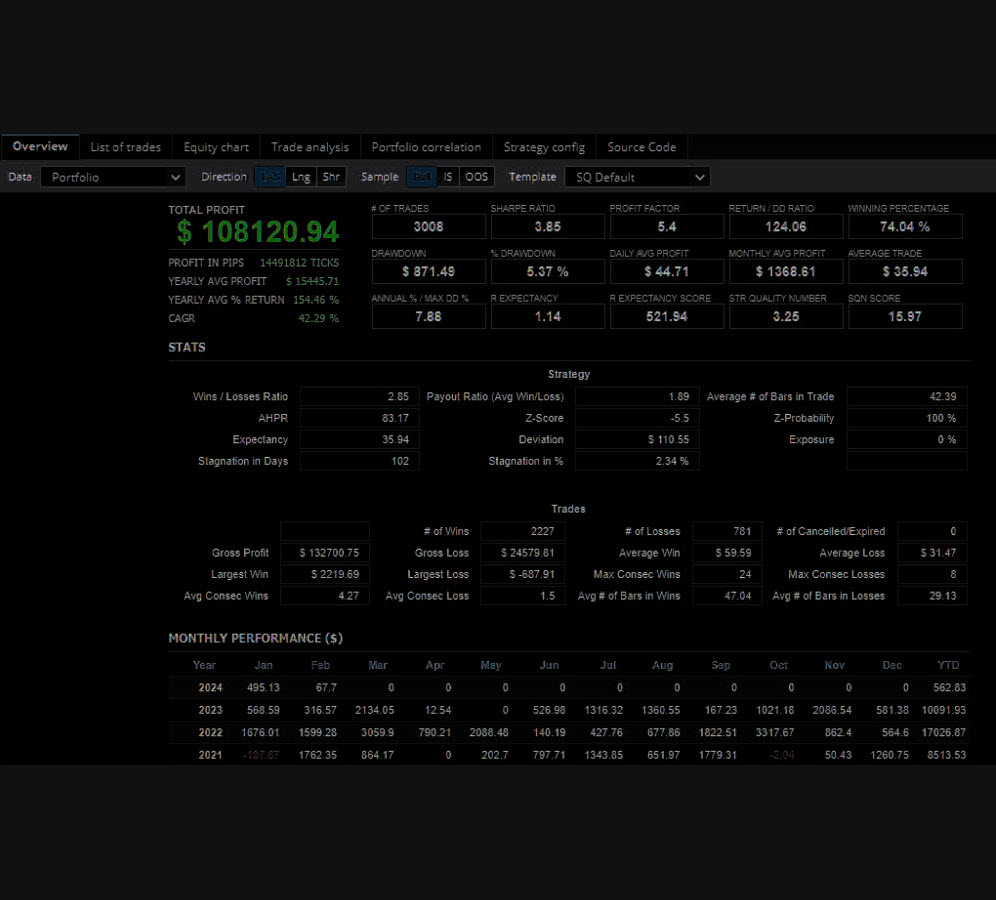

Here’s a snapshot of how the portfolio has performed:

- Total Return: +55.0%

- Monthly Return: +7.0%

- Weekly Return: +1.6%

- Closed Profit: $10,599.04

- Peak Drawdown: -1.5%

- Trade Win Percentage: 77.1%

- Profit Factor: 4.02

- Trades per Day: 3.0

- Total Trades: 573

Portfolio Breakdown

The portfolio is well-diversified across various index CFDs. Here’s a closer look at the performance of some key components:

- JP225: 141 orders, net profit of $737.70, profit factor 3.07, win percentage 79.0%

- USTEC: 53 orders, net profit of $3,100.72, profit factor 47.06, win percentage 77.0%

- US30: 31 orders, net profit of $1,524.40, profit factor 9.78, win percentage 77.0%

- HK50: 28 orders, net profit of $302.35, profit factor 7.69, win percentage 71.0%

- F40: 38 orders, net profit of $683.18, profit factor 4.56, win percentage 71.0%

Focus on Drawdown

One of the key goals for this system has been to minimize drawdowns, and I’m happy to report that the peak drawdown was just -1.5%. This conservative approach helps maintain steady growth while protecting the portfolio from significant losses.

Comparison with Buy-and-Hold Strategy

Comparing this algorithmic strategy with a traditional buy-and-hold approach reveals some interesting insights. While a buy-and-hold strategy exposes the portfolio to higher drawdowns and volatility, the algorithmic system has managed to keep drawdowns to a minimum. For example, during market downturns, a buy-and-hold portfolio might experience drawdowns exceeding 10-15%, whereas our system’s drawdown has been limited to 1.5%. This not only preserves capital but also reduces the psychological stress associated with significant losses. If you accept higher drawdown, increase the lot size

Conclusion

In conclusion, the first six months of running our algorithmic swing trade portfolio have been promising. With a total return of 55%, a monthly return of 7%, and a low peak drawdown of 1.5%, the system has demonstrated its capability to achieve steady growth while effectively managing risk. Comparing it with a buy-and-hold strategy further highlights the benefits of an algorithmic approach in terms of lower drawdowns and more consistent performance.

However we expect draw down to hit the 20-25% mark from MonteCarlo analyses shuffeling the trades.

Thank you for following along this journey. I look forward to sharing more updates and insights as we continue to refine and enhance our systems. There is more to come from this approach.